(888) 979-7969

(888) 979-7969

(888) 979-7969

(888) 979-7969

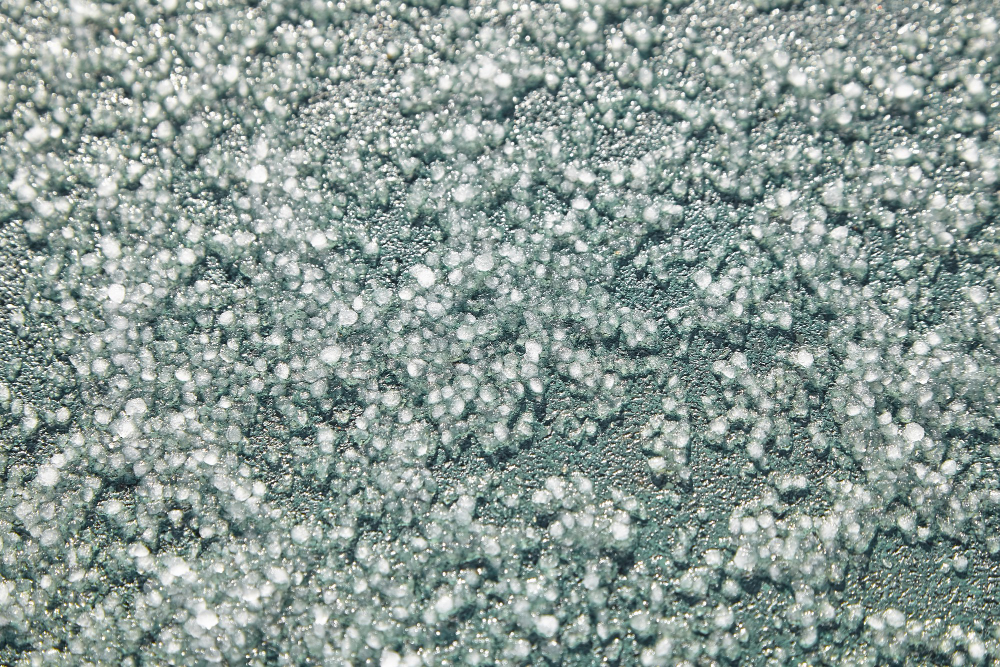

Hail damage can be a nightmare for homeowners, leaving behind ugly dents, cracks, and leaks in roofs, siding, and windows. If you've experienced hail damage to your property, you may be wondering how to file a claim with your insurance company and get the compensation you deserve. In this blog post, we'll cover everything you need to know about hail damage claims, including the process of filing a claim, what your insurance policy covers, and tips for working with an insurance loss adjuster. If you're looking for an insurance loss adjuster in Orlando, FL, contact Ultra Property Damage today for a free consultation.

Before you file a hail damage claim, it's important to understand what your insurance policy covers. Most homeowner's insurance policies cover damage caused by hail, but the specifics vary from policy to policy. Some policies may have specific exclusions, such as damage caused by wind-driven rain or flooding, so be sure to read your policy carefully. It's also important to understand your deductible, which is the amount you'll have to pay out-of-pocket before your insurance company will cover the rest of the damage.

To file a hail damage claim, start by calling your insurance company's claims department or filing a claim online. Be prepared to provide information about the date and time of the hailstorm, the location of the damage, and the extent of the damage. Your insurance company may send an adjuster to inspect the damage and provide an estimate of repairs. Be sure to document the damage with photos and videos, and keep a record of all communication with your insurance company.

An insurance loss adjuster is an independent professional who works on behalf of the policyholder to assess and negotiate the amount of compensation for a claim. If you're not satisfied with your insurance company's estimate of damages, you may want to consider hiring an insurance loss adjuster to advocate on your behalf. Loss adjusters will typically charge a percentage of the settlement they help you negotiate, but they can help you get a higher payout and ensure that all damages are accounted for.

To maximize your compensation for hail damage, follow these tips:

Hail damage claims can be frustrating and time-consuming, but with the right information and support, you can get the compensation you deserve. Be sure to understand your policy, document the damage, and work with experienced professionals to get a fair settlement. If you're looking for an insurance loss adjuster in Orlando, FL, Ultra Property Damage can provide you with a free consultation and help you navigate the claims process. Contact us today to learn more.