(888) 979-7969

(888) 979-7969

(888) 979-7969

(888) 979-7969

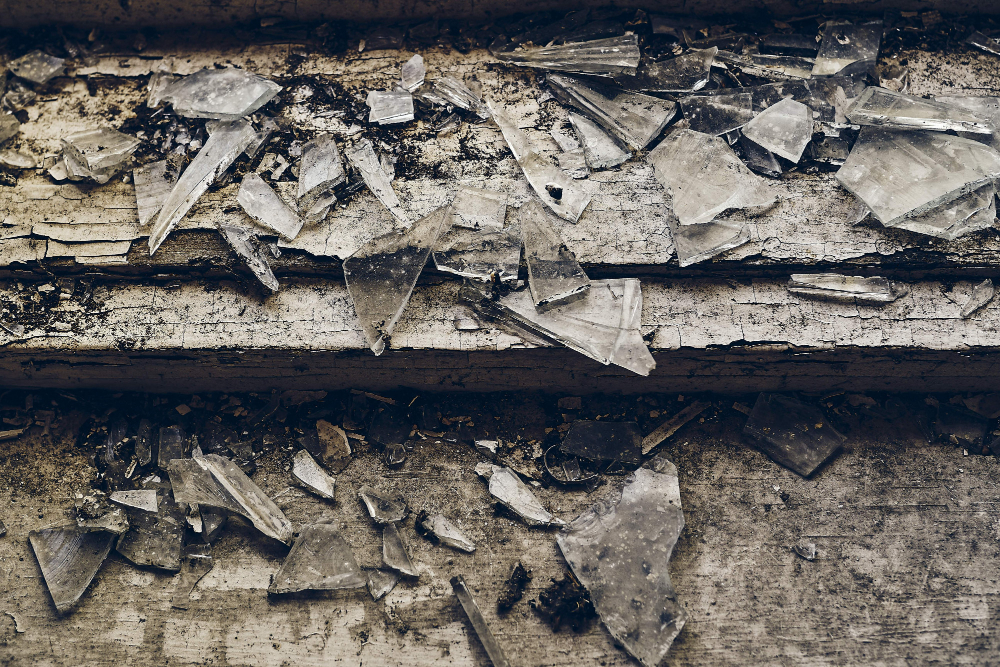

Natural disasters are an unfortunate reality in many parts of the world, and for property owners, the aftermath can be daunting. Earthquakes, in particular, can cause extensive damage to both residential and commercial properties, leading to significant financial and emotional stress. It's crucial to have a clear understanding of what steps to take if your property is damaged in an earthquake, ensuring a smoother recovery process. Here's your essential guide to handling earthquake property damage.

The first step after sustaining earthquake property damage is to review your insurance policy to understand what is covered. Earthquake damage is generally not covered under standard homeowners or business insurance policies, and a separate earthquake insurance policy is required. This specialized policy can provide coverage for damage to your building, personal property, and additional living expenses if you're forced to vacate your home.

However, limits and deductibles for earthquake insurance can be significantly higher than those for other types of coverage, so it's essential to understand the specifics of your policy.

Your policy declaration page will clearly outline what is covered under your earthquake insurance, as well as any additional coverage options you may have. Review these carefully, paying close attention to:

Understanding these elements will give you a clearer picture of the financial assistance available to you.

When it's safe to return to your property, documenting the earthquake damage is crucial for the claims process. Take photos and videos from multiple angles to provide a comprehensive record of the damage. Make a detailed list of all damaged items, including their age and value, if known.

Always prioritize safety when returning to a damaged property. Wear protective gear, monitor for hazards like gas leaks or structural instability, and only perform actions that do not put you at risk.

You can also consider hiring a public insurance adjuster with experience in earthquake claims. They can offer expertise in evaluating the damage and negotiating with your insurance company on your behalf.

After documenting the damage, it's time to file a claim with your insurance company. Most earthquake insurance providers have specific procedures for submitting a claim, which may include a deadline for reporting. Contact them as soon as possible to get the process started.

Your insurer will require various pieces of information for your claim, such as:

Filing a claim promptly and providing thorough information will help expedite the claims process.

Once your claim is filed, your insurance company will likely send an adjuster to inspect the damage. This adjuster will evaluate the loss and provide a report to your insurance company.

It's advisable to be present during the inspection to ensure all damage is noted and properly evaluated. If you're working with a public insurance adjuster, they can represent you during this process.

The adjuster's report will detail the extent of the damage and any recommended repairs or replacements. You will receive a copy, and the information within may be used to calculate your settlement amount.

Once the claim is processed, you will receive a settlement offer from your insurance company. This offer should cover the cost to repair or replace the property to its pre-damaged condition.

Carefully review the settlement offer to ensure it aligns with the terms of your policy and the reported damage. If you believe the offer is insufficient, you have the right to appeal or negotiate for a higher amount.

You can present a counteroffer to your insurer, supported by additional documentation or a second opinion from a contractor. Your public adjuster can guide you through this process and help secure a fair settlement.

Once a settlement is reached, you can begin the process of rebuilding and restoring your property. Use the funds provided by your insurance company to hire reputable contractors and purchase quality materials.

Selecting a contractor experienced in earthquake damage repairs is critical. Ensure any contractor you hire is licensed, bonded, and insured, and ask for references from previous clients.

Compliance with local building codes and obtaining the necessary permits is a must when rebuilding. Your contractor should handle these aspects, but it's essential to be aware of the process.

As you restore your property, consider ways to mitigate future earthquake damage. Retrofitting your home with features like anchor bolts, steel plates, or bracing for heavy objects can enhance its structural integrity and safety.

Seek advice from structural engineers or other earthquake safety experts to learn about the best methods for protecting your property against seismic events.

If your home is uninhabitable due to earthquake damage, your earthquake insurance may cover additional living expenses. Keep detailed records of your temporary living costs, such as rent, food, and transportation, as these can be reimbursed.

Experiencing earthquake property damage is a distressing event, but with the right approach, recovery is entirely possible. By understanding your coverage, documenting the damage, and working with knowledgeable professionals, you can secure the necessary funds to repair and rebuild your property.

If you find yourself facing earthquake property damage and are in need of an insurance loss adjuster in Orlando, FL, remember Ultra Property Damage. Our experienced team is committed to guiding you through the claims process and ensuring you receive a fair settlement. Contact us today for a free consultation and take the first step towards restoration.